do i need a tax exempt certificate

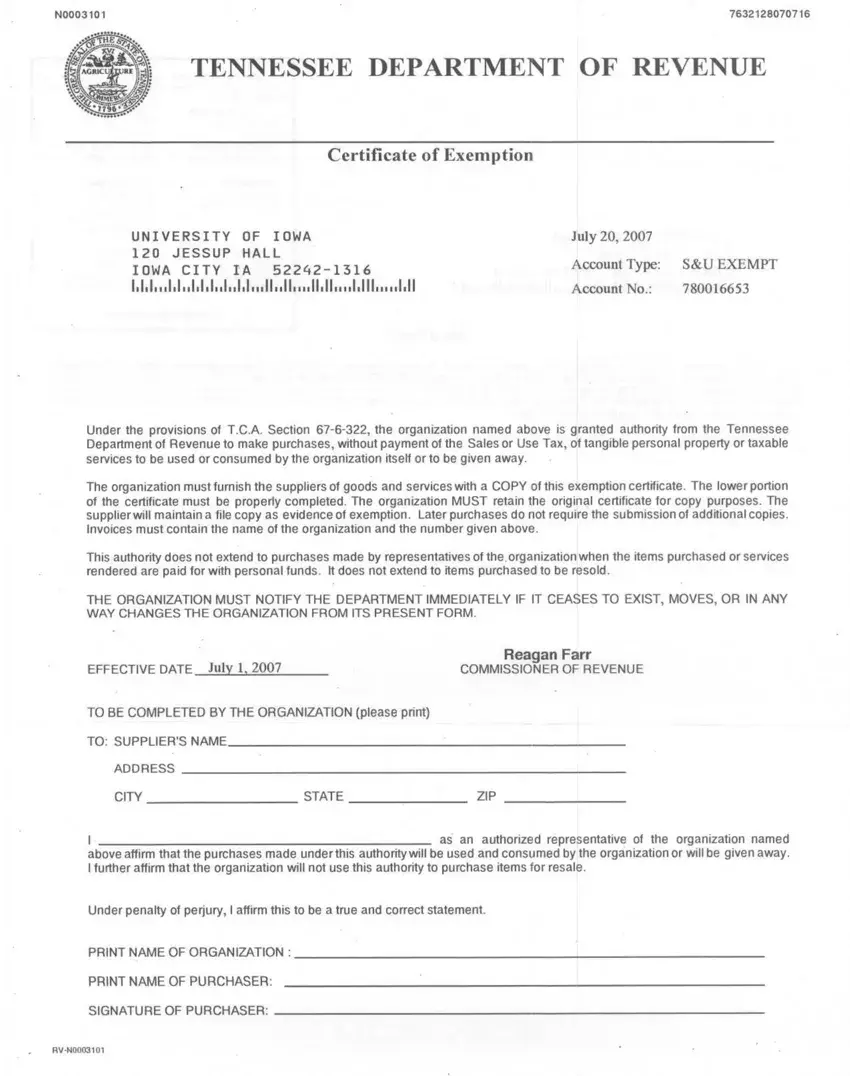

Types of Exemptions. The form is dated and signed.

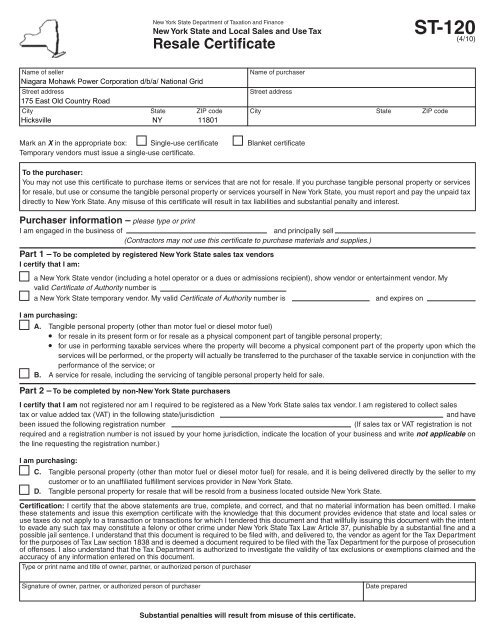

New York Sales Tax Exemption Form National Grid

508a and to file an annual information.

. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. You should require a certificate every time. Proof of payment of PHP 100 Certification Fee and PHP 30.

Names and addresses of the seller and purchaser. When an exemption certificate is needed. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic.

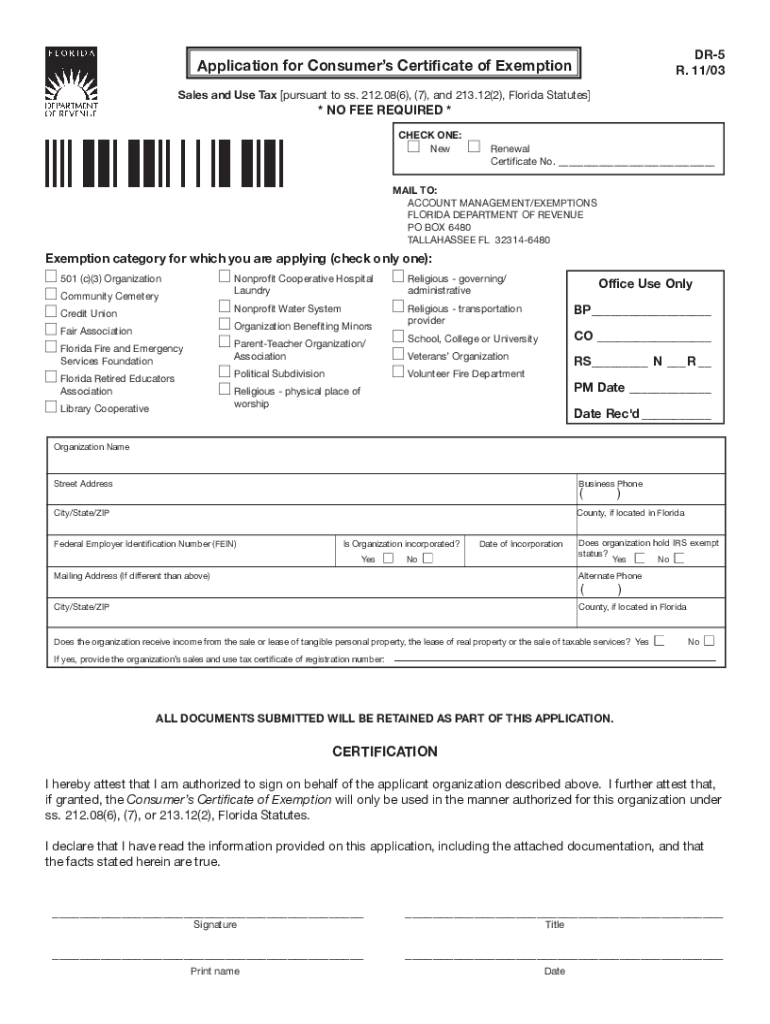

To apply for tax-exempt status the following must happen. An EIN or Employee Identification Number must be obtained. A new tax-exempt customer is buying from you for the first time.

As of January 31 2020 Form 1023 applications for. Vehicles are exempt if the following apply. You can also search for information about an organizations tax-exempt status and.

The name of the. To apply for an exemption certificate complete the Maryland SUTEC Application form. A tax exempt certificate must contain the following information.

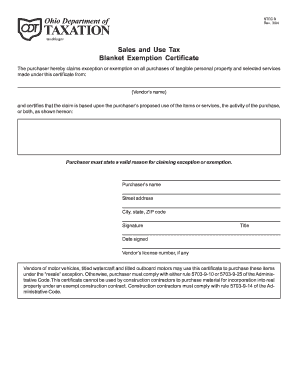

Description of goods being purchased. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Complete the Type of Business Section.

They have a maximum speed of 8mph on the road. Type of exemption claimed. Mobility vehicles and powered wheelchairs.

The seller fraudulently fails to. All information on the certificate is completed. To apply for tax exemption in relation to the personal income of Persons with Disabilities an applicant is expected to fill induplicate Tax exemption form and attach the.

A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. Only one category of exemption may be claimed on a Certificate. Persons who are earning more than 26000 per year are charged a flat tax rate of 25.

If you cannot claim other exemptions because. The application may also be obtained by. Incomplete Certificates are not considered to be accepted in good faith.

They are fitted with a device that limits them to 4mph. Exemptions are based on the customer making the. How to Apply for an Exemption Certificate.

A certificate you have on file for an existing customer is invalid or is. You have been out of the country more than once in a 30-day period or because. Certificate of Low Income or No Income signed by the Barangay Chairman of the place where the applicant resides.

The FUTA tax rate is 6 and applies to the first 7000 in. Most tax-exempt organizations are required to file an application for recognition of tax-exempt status with the IRS under 26 USC. Those who are employed and reside in Belize and whose total income per annum from all.

A seller is not relieved of its liability to collect and remit the applicable Wisconsin sales or use tax on a sale to a purchaser if any of the following apply. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. The Financial Services Commission the FSC is a statutory authority established to regulate supervise non-bank financial services provided by entities licensed or registered under the.

Here are several steps a company should take to validate a certificate. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. How to use sales tax exemption certificates in South Carolina.

Vendors should retain copies of the Form 5000 for. The funds from FUTA tax help provide unemployment compensation payments to workers who have lost their jobs. A copy of the articles of incorporation must be submitted.

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Tax Exemption Certificate 7 2027 Zephyrhills Fl

W9 Tax Exemption Certificate Sun Prairie Wi Official Website

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

What Is An Example Of A Tax Exemption Certificate

Sales Tax Exemption For Building Materials Used In State Construction Projects

How To Get A Tax Exempt Certificate Florida 2003 Form Fill Out Sign Online Dochub

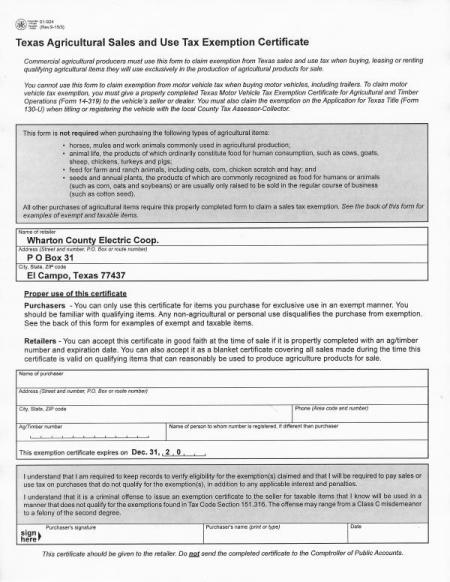

Ag Sales Use Tax Exemption Wharton County Electric Cooperative

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Missouri 149 Sales And Use Tax Exemption Certificate

Save Time And Money On Sales Tax Exemption Certificate Paperwork

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Texas Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Campus Controller S Office University Of Colorado Boulder

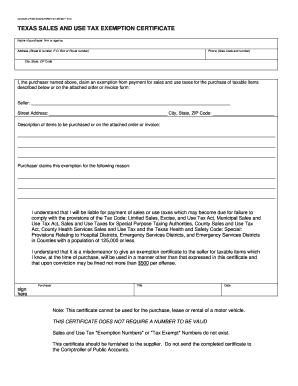

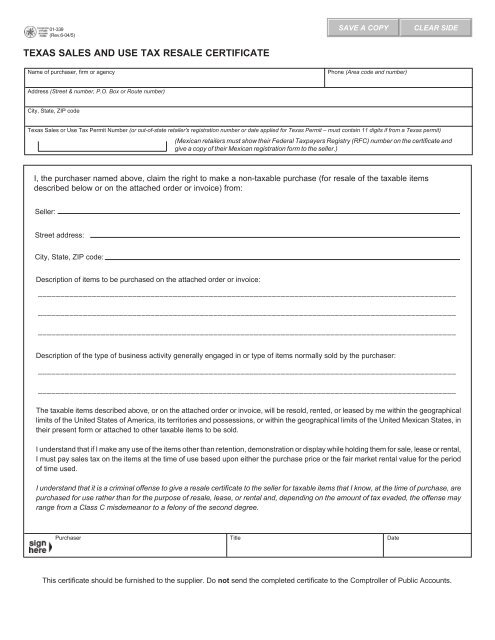

Texas Sales And Use Tax Exemption Certificate

How To Get An Exemption Certificate In Pennsylvania Startingyourbusiness Com

Printable California Sales Tax Exemption Certificates

Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller